From a global stage, Inflation is not a solitary player. It emerges as a pervasive force, that is shaping challenges and transformations across nations. As the world grapples with fluctuating economic landscapes, inflation remains a pivotal force, shaping the cost of living and the pulse of markets. In 2022, the world witnessed an average inflation rate of 7.97%, a stark rise from previous years, signaling a shift in the economic equilibrium. This surge was a ripple effect of various factors, including the aftermath of a pandemic, geopolitical tensions, and supply chain disruptions.

The Prospects Group at the World Bank has compiled a comprehensive global database on inflation, spanning 209 countries from 1970 to 2023. It encompasses multiple inflation metrics like the consumer price index (CPI), including the headline, food, and energy CPI, as well as core CPI, producer price index, and gross domestic product deflator.

Locally, inflation brings about diverse consequences, like diminishing consumer purchasing power, influencing interest rates, and altering borrowing costs. It also plays a role in shaping business strategies, wage levels, and job availability. For those pursuing remote job opportunities or scholarships, grasping the local effects of global inflation is essential. It can impact funding availability, salary prospects, and living expenses.

Kenya’s Current Inflation Climate:

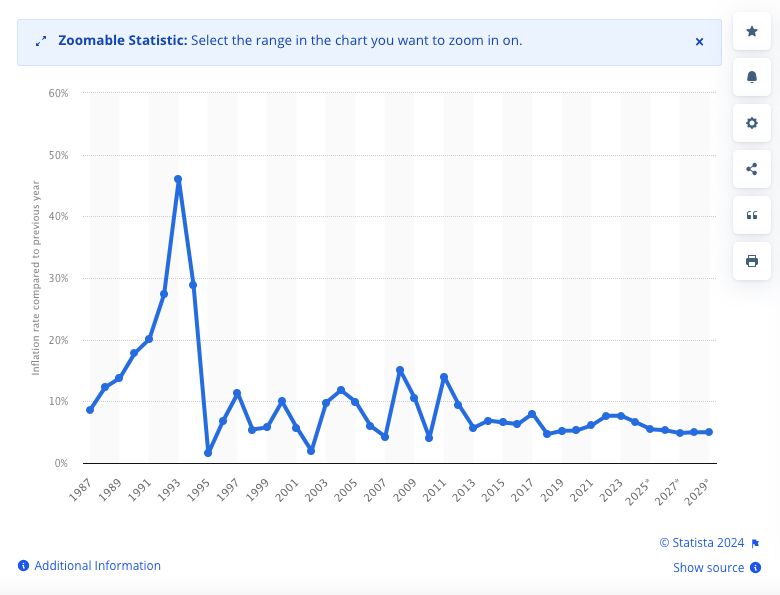

Kenya, a vibrant nation in East Africa, has not been immune to these global currents. The country’s inflation rate has seen its ebbs and flows, with a notable decrease in 2018 to 4.69% from 7.99% the year prior. This trend was a breath of relief for businesses and consumers alike. As of 2023 and into 2024, Kenya’s inflation narrative becomes more nuanced. The Central Bank of Kenya reports a 12-month inflation rate of 5.00% in April 2024, with preceding months showing a gradual decrease from a high of 6.85% in January. However, the winds of change are ever-present, and forecasts suggest a leveling off around 5% in the near future. This data is crucial for businesses and citizens, as it reflects the purchasing power of the Kenyan shilling and the cost of goods and services.

Kenya: Inflation rate from 1987 to 2029 | Credits: Statista

What Causes Inflation?

Inflation stems from various interconnected factors, each contributing to its classification into distinct types:

Can inflation get extreme? Yes, the result is Hyperinflation

Hyperinflation, an extreme form of inflation, wreaks havoc on economies and citizens alike. Its impacts are dire: currency trust plummets, driving a shift towards foreign currencies or tangible assets like gold. Hoarding ensues, triggering shortages and fueling further price hikes. Savings rapidly lose value, while wages struggle to keep pace with inflation, causing a spiral of economic imbalance. Social unrest brews, fueled by economic stress, sometimes leading to political instability. In the worst-case scenario, hyperinflation spells economic collapse, as the monetary system crumbles, grinding economic activities to a halt. It’s a catastrophic cycle, impacting nearly every facet of life for those ensnared within its grip.

Strategic Navigation:

Understanding inflation is crucial for entrepreneurs and investors, akin to reading the skies before setting sail. Inflation influences costs, pricing strategies, and investment returns. A rising inflation rate can erode profit margins and deter investment, while a stable or decreasing trend can foster a conducive environment for business growth and attract investors.

Kenya has not been passive in the face of inflation. The government and businesses alike have taken a strategic approach to mitigate its effects. From implementing fiscal policy changes to embracing innovative investment trends, the nation has shown resilience and adaptability.

Inflation’s impact extends beyond balance sheets; it touches lives. For the average Kenyan, fluctuations in inflation mean changes in the price of goods and services, affecting daily budgets and long-term financial planning. It’s a common thread in the fabric of society, one that weaves through every market transaction and household expense.

What does the future hold? How to Mitigate the effects of inflation:

Looking ahead, the interplay of global influences and local dynamics will continue to shape Kenya’s inflationary landscape. Addressing the impacts of inflation demands a multifaceted approach, spanning both individual and organizational levels. Here are key strategies to consider:

In times of inflation, individuals can take proactive steps to safeguard their finances. One effective strategy is to review and adjust budgets regularly, accommodating increased costs. Diversifying income sources can also enhance financial resilience, providing additional streams of revenue. Moreover, paying down high-interest debt prevents inflation’s compounding effect on interest payments. Investing in instruments like Treasury Inflation-Protected Securities (TIPS) or high-yield savings accounts further protects savings against inflation’s erosive effects.

For businesses navigating inflationary pressures, strategic adjustments are essential. Consider adapting the product portfolio to emphasize items with stable demand and margins. Repositioning the brand to highlight value-based offerings can attract price-sensitive consumers. Revamping pricing models to reflect current market conditions ensures competitiveness. Operational efficiency gains, such as streamlining supply chains and reducing costs, help mitigate the impact of rising prices.

At the governmental level, policymakers play a crucial role in managing inflation. Monetary policy adjustments, including interest rate changes, regulate money supply and demand, stabilizing prices. Fiscal policy, through government spending and taxation measures, influences economic growth and inflation rates. In certain circumstances, implementing temporary price controls on essential goods and services can provide immediate relief from inflationary pressures.